RATE PROMOTIONS

Promotions are limited opportunites that allow our investors to earn a great return on their investment.

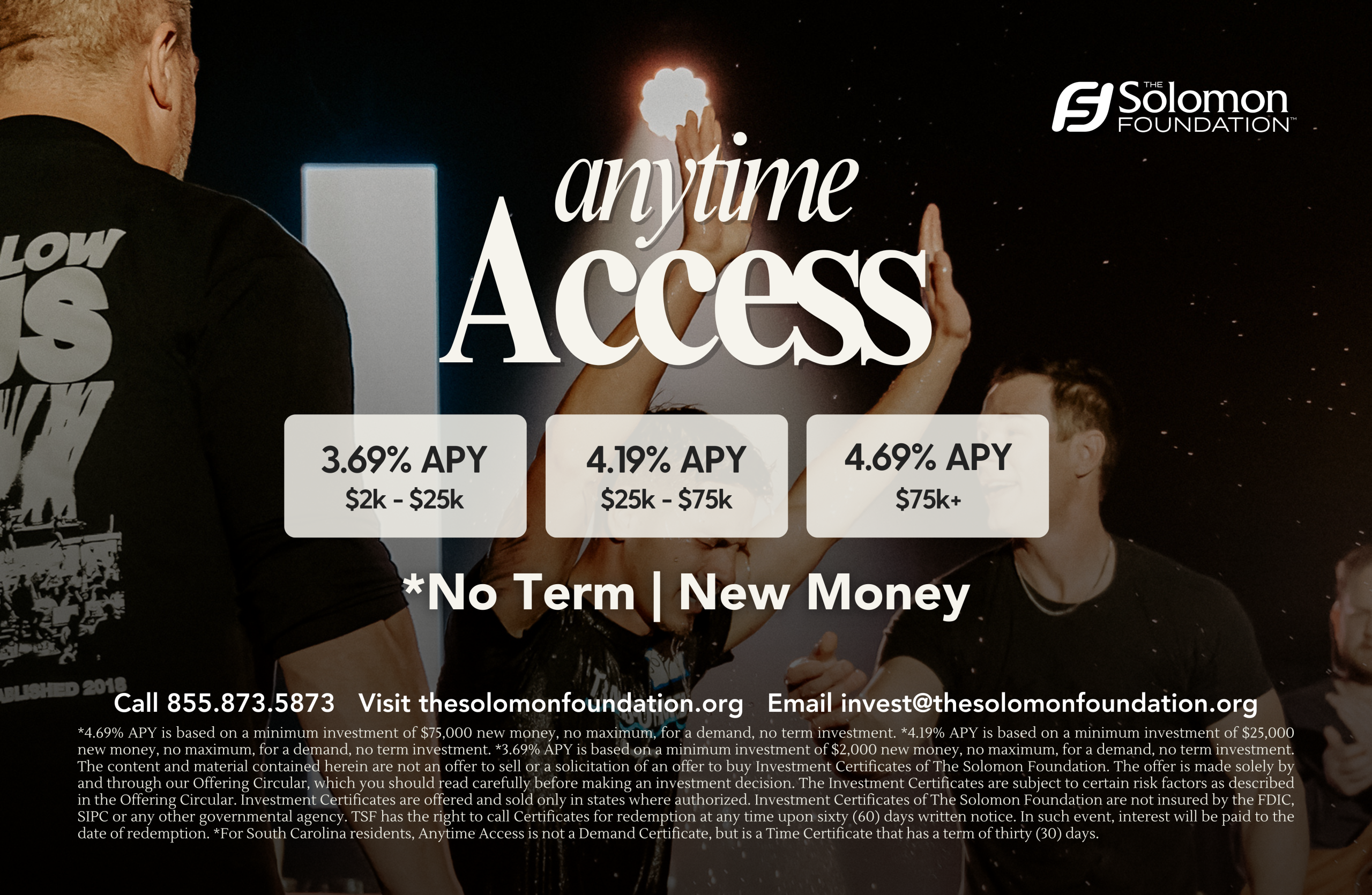

CURRENT PROMOTION

HOW DO I INVEST?

New Investors

Option 1: Online

If you’re a new investor, this is the easiest way to invest in one of our Rate Promotions.

1. Visit thesolomonfoundation.com/invest-now and select your promotion.

Option 2: Form

1. Visit thesolomonfoundation.com/investment-forms or click this button.

2. Under “Investment Forms“ and “New Investment (Non-Retirement),“ select one of the two options depending on whether you’re an individual or an organization.

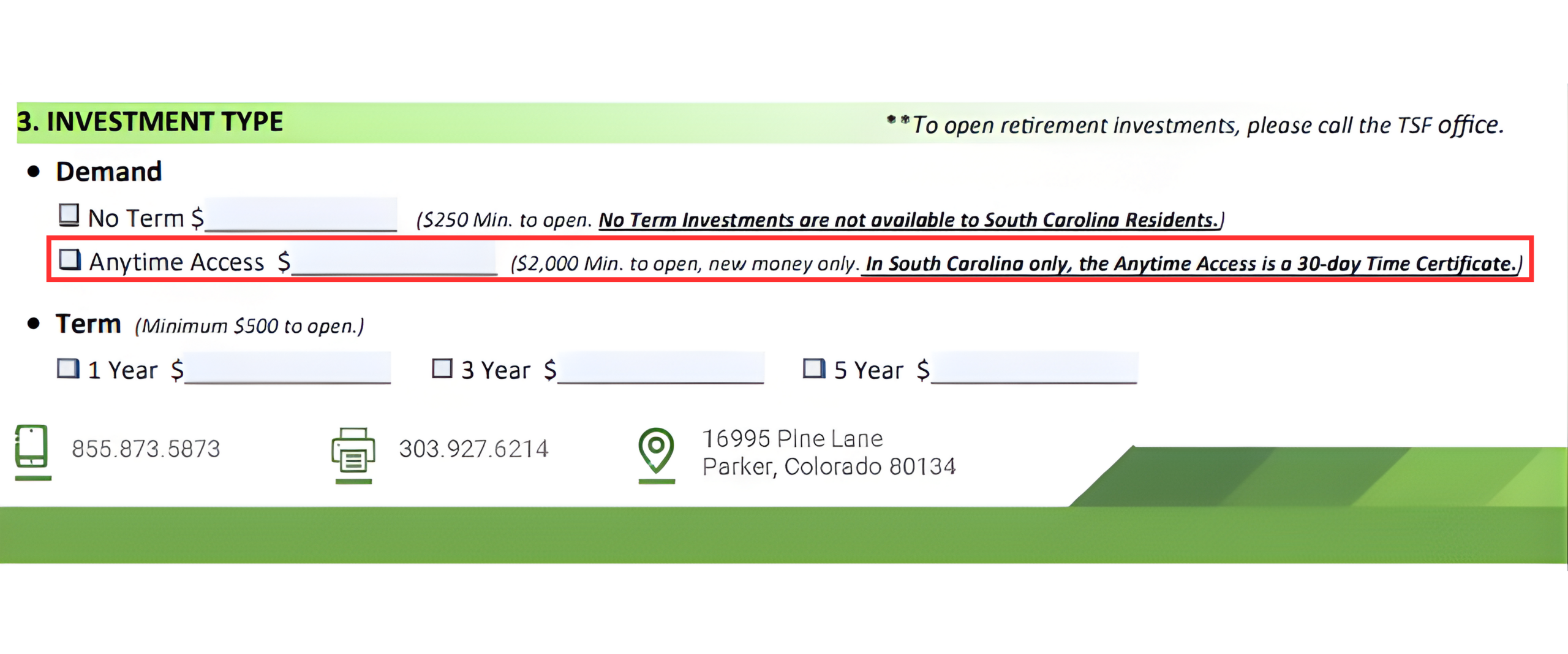

3. Fill out the form. Under “3. Investment Type,“ check which Rate Promotion you’d like to invest in (e.g. Anytime Access) and fill in the amount (e.g. $2k for 3.69% APY) you’d like to invest.

4. For further instructions on how to submit this form, please call or email us.

Existing Investors

If you’re an existing investor and don’t have online access, you can call us Monday through Friday from 7 a.m. to 5 p.m. at 855.873.5873 to set up your account portal.

However, if you do have online access, please follow these instructions:

1. Click on “Client Login“ on TSF’s website header and log in to your account.

2. On the side menu of your client portal, click “Purchase New Investment.“

3. Complete steps 1-3 (Offering Circular and Agreements, Ownership Type Selection, Fund Investment) on the application.

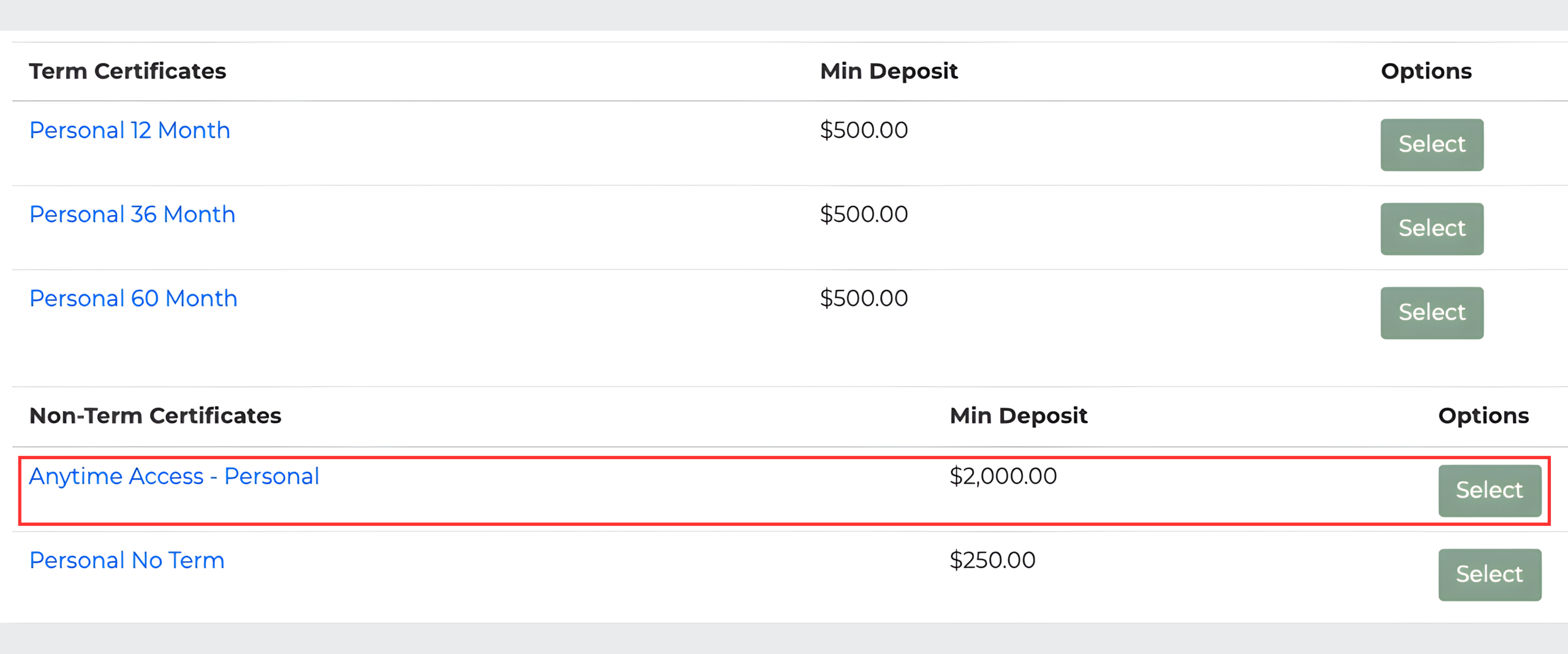

4. Complete step 4 (Select Investment Type) on the application. Select which Rate Promotion you’d like to invest in (e.g. “Anytime Access” under “Non-Term Certificates”).

5. Complete steps 5-6 (Interest Distribution, Fund Investment) on the application. Click “Submit Application“ when finished.

If you need further assistance, you can call us Monday through Friday from 7 a.m. to 5 p.m. at 855.873.5873.

You can also reach the Investment Team directly by sending an email to invest@thesolomonfoundation.org.

Frequently Asked Questions

Curious if a Promotion is the right choice for you? Check out these common questions to learn more. If you need further assistance, don’t hesitate to contact us—we’re happy to help!

If a promotion says that it is for “new money only,” what does that mean?

“New money” refers to funds that are not already invested at TSF. Funds already at TSF may not be transferred to any promotion that says it is for new money only, or paid out to a bank account and then drafted to that promotion.

How long will this promotion last?

There is currently no end date for Anytime Access so take advantage of this promotion while you can!

Are these available for retirement investments?

Yes.

Can I add to these?

Yes, all promotional investment types allow deposits. Anytime Access allows deposits of new funds only.

What do I need to do to get started?

If you’re interested in an IRA in one of our promotions, please contact us.

If you’re considering an investment other than a retirement account, see instructions above, or contact the Investments Department.

What kind of digital signature is acceptable?

We can only accept digital signatures via an electronic signature software such as Esign, and it must be accompanied by the audit page. Please contact us and we’re happy to initiate an Esign form for you.

Can I take out my interest, and when?

Yes, you can have your interest paid out to your bank account at the end of each calendar month or calendar quarter.

What’s the penalty if I need to withdraw funds?

There is no penalty for withdrawing funds from an Anytime Access account.

What happens when it matures?

If the term is no longer offered, you can communicate what you’d like to happen at that time. Options include transferring funds to another investment, choosing a new term, and more.

If we don’t hear from you, certificates in California and Washington will be closed and paid to you, per state requirements. Certificates in Oregon will be converted to a No Term at the rate offered, per state requirements. Other states will be converted to a similar term at the rate then offered.

What’s your next special promotion?

We will let you know when it’s available!

What’s the difference between APY and APR?

APR is Annual Percentage Rate, or the rate used to calculate your interest daily. APY is Annual Percentage Yield, which is the rate earned when considering the impact of interest compounded quarterly.

HAVE QUESTIONS?

WE’RE HERE TO HELP

- Contact our support team for answers to all your questions

- info@thesolomonfoundation.org

- 855.873.5873